Investors have a lot of choice and you are in competition with all other investment opportunities, the final decision on which gets investment will be those with the best combination of good sustainable profit and lowest risk.

Investors have a lot of choice and you are in competition with all other investment opportunities, the final decision on which gets investment will be those with the best combination of good sustainable profit and lowest risk.

That may not be the highest profit, or the least risk, but an acceptable (to that Investor) mixture of the two.

The following will greatly help your chances of investment:

1. Know your market

- Show it is growing and sustainable (use facts)

- That you know the competition

- You can say what your competitive edge or uniqueness is

- What issue or need you will address

- Who will buy your product / service (your target customer)

2. Proof

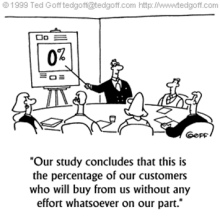

Great ideas are a dime a dozen and investors have heard all the hype before, the more you can do to show your concept works and people will buy it, the better your chances of investment.

- Projects just at the idea stage seldom get funding

- For new products you at least need a prototype

- For services or retail you need at least some sales

3. Gain confidence in your ability to grow their investment and that you can work with the Investors

- Previous experience in this market

- Good work ethic and energy

- Confident, not arrogant, you must be open to input and be flexible

- Ideally an experienced team of people who can execute the plan, this isn’t always possible, so show you know where gaps may be and how you will fill them. Too many gaps however will start to increase the risk

4. Business model and implementation

- How you will make money (and a profit) from this great opportunity

- Understand all the costs and numbers, making sure they are realistic

- An exciting but achievable sales forecast

- It’s not often the idea but how it is implemented that counts, show that you understand this

5. Skin in the game

- Have you invested your own money in this? Investors like to see that you are committed and taking the same risks that they are. Sometimes your own funds may not allow much opportunity to do so; in which case you will need to talk about the other commitments you’ve made to the business.

6. Government tax breaks and Incentives

In the UK there is the Enterprise Investment Scheme (EIS), in the USA there are local State incentives to encourage new small businesses in their area. Some States have more advantageous and flexible tax breaks if you incorporate there, such as Delaware, Nevada and Wyoming.

Where ever you are, look into such incentives and show Investors you are knowledgeable. Don’t expect free grants to be available anywhere however, those days are past.

7. Lean start-up

Investors will expect you to use their investment to grow the business. Not mainly to pay you a salary or provide you with corporate luxuries. Show you are using the lean start-up principle; you can begin taking a better salary and working conditions as the profit grows.

Finally, make sure your plan is clear and that you are able to describe in a sentence what your business does. In one more sentence you should be able to describe your business model (how you will make money from the activity).

Clarity goes a long way in convincing Investors that you know what you are doing and that they can intrust their funds to you.

Due-diligence needs thinking about for Investors when they are about to embark on an investment. However it’s just as applicable for those who are seeking investment to check out a potential Investor. In both cases you should verify that the person, business and facts as stated are correct.

Due-diligence needs thinking about for Investors when they are about to embark on an investment. However it’s just as applicable for those who are seeking investment to check out a potential Investor. In both cases you should verify that the person, business and facts as stated are correct. You don’t know when you might bump into or be talking to a useful contact, business partner or even potential Investor. This first conversation is your best chance to impress and could determine whether you get a second more detailed conversation or meeting.

You don’t know when you might bump into or be talking to a useful contact, business partner or even potential Investor. This first conversation is your best chance to impress and could determine whether you get a second more detailed conversation or meeting. Being investment ready is key to getting funding. Yet when talking to entrepreneurs they often have not taken the time to think it through.

Being investment ready is key to getting funding. Yet when talking to entrepreneurs they often have not taken the time to think it through. Many of the people that I’ve talked to recently are individuals, they have a need for funding to start-up or to get greater growth, so they are talking to me about finding investment.

Many of the people that I’ve talked to recently are individuals, they have a need for funding to start-up or to get greater growth, so they are talking to me about finding investment. Whether you’re writing a business plan, or simply want to make sure that your business has customers, you are going to need a sales plan and a marketing plan.

Whether you’re writing a business plan, or simply want to make sure that your business has customers, you are going to need a sales plan and a marketing plan. I often get calls from members who are looking for a Business Partner or Investor but are concerned about how much they can reveal of their business idea.

I often get calls from members who are looking for a Business Partner or Investor but are concerned about how much they can reveal of their business idea.