Business Partners

Every enterprise that isn’t a sole trader will have people who are working together as partners to drive that business towards its goals.

This can be in a business that is registered as a legal partnership (see below), fellow directors of a company, or at its most simple just 2 people working together with no legal entity formed. Let’s look at the most common types of partnerships:

1. A General Partnership:

Where 2 or more people work together sharing responsibilities without a separate legal entity being formed. Profits and liabilities are shared. The least complicated, however it does mean each individual is personally liable for any debts that result from the business.

Although not a legally registered entity, HMRC must be told that you are working as a Partnership with someone and the income is included in your personal self-assessment.

2. Limited Partnership (LP):

At least one, or more, partners must take full responsibility and liability for the business and are known as a General Partner, similar to above. These must also be the only ones that take the management decisions.

Others can join as Limited Partners by putting capital into the business and their liability is limited to the amount they have put in. HMRC must be told and the partnership registered with Companies House. Each partner includes their portion of the profits within their own personal taxation.

This is a popular entity for Venture Capital companies, where there is a management team of General Partners, with other Limited Partners who invest funds into the portfolio.

3. Limited Liability Partnership (LLP):

For most partnership businesses this is a good choice, since it protects the individual partners against the business liabilities. You’ll need at least 2 “designated” members of the partnership who take on the HMRC and Companies House responsibility.

Other partners are termed “ordinary” members of the partnership. Again each is taxed on their income from the partnership as individuals.

Professional services such as solicitors sometimes prefer this legal entity for the flexibility it provides in bringing in new partners and altering profit sharing arrangements.

4. Directors of a Company:

Although not normally thought of as a ‘partnership’ in the legal sense, I include this because many companies will take on a new business partner and make them a director of the company. In this regard it is the most common “business partnership” and has the attraction of being well understood, protects personal liability and can give tax flexibility.

If starting a new business you have the opportunity to chose a format that works well for you. So it’s a good idea to check with your accountant on which legal entity is best for your personal circumstances.

Due-diligence needs thinking about for Investors when they are about to embark on an investment. However it’s just as applicable for those who are seeking investment to check out a potential Investor. In both cases you should verify that the person, business and facts as stated are correct.

Due-diligence needs thinking about for Investors when they are about to embark on an investment. However it’s just as applicable for those who are seeking investment to check out a potential Investor. In both cases you should verify that the person, business and facts as stated are correct. I talk to a lot of owners of businesses each year who are putting all their time, energy and money into growing their business and have no plans to use any of that hard fought cash to pay into a pension.

I talk to a lot of owners of businesses each year who are putting all their time, energy and money into growing their business and have no plans to use any of that hard fought cash to pay into a pension.

You don’t know when you might bump into or be talking to a useful contact, business partner or even potential Investor. This first conversation is your best chance to impress and could determine whether you get a second more detailed conversation or meeting.

You don’t know when you might bump into or be talking to a useful contact, business partner or even potential Investor. This first conversation is your best chance to impress and could determine whether you get a second more detailed conversation or meeting. 1. Work on your brand and image.

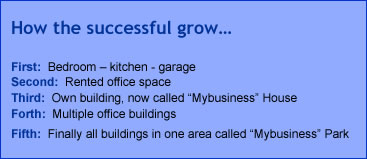

1. Work on your brand and image. Being investment ready is key to getting funding. Yet when talking to entrepreneurs they often have not taken the time to think it through.

Being investment ready is key to getting funding. Yet when talking to entrepreneurs they often have not taken the time to think it through. Many of the people that I’ve talked to recently are individuals, they have a need for funding to start-up or to get greater growth, so they are talking to me about finding investment.

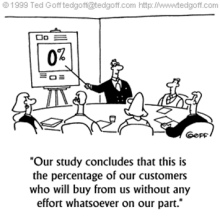

Many of the people that I’ve talked to recently are individuals, they have a need for funding to start-up or to get greater growth, so they are talking to me about finding investment. Whether you’re writing a business plan, or simply want to make sure that your business has customers, you are going to need a sales plan and a marketing plan.

Whether you’re writing a business plan, or simply want to make sure that your business has customers, you are going to need a sales plan and a marketing plan.