Due-diligence needs thinking about for Investors when they are about to embark on an investment. However it’s just as applicable for those who are seeking investment to check out a potential Investor. In both cases you should verify that the person, business and facts as stated are correct.

Due-diligence needs thinking about for Investors when they are about to embark on an investment. However it’s just as applicable for those who are seeking investment to check out a potential Investor. In both cases you should verify that the person, business and facts as stated are correct.

That’s not being mistrustful it’s just being business-like and expected by all parties to a potential funding agreement.

There are several types of due-diligence, not all will necessarily be relevant and this list is not exhaustive, but does illustrate the common areas to consider:

Legal

- Are there IP (Intellectual Property) rights involved?

- Any pending litigation or disputes?

- Legal structure and ownership including share holdings and any restrictions

- Regulation or licences that may be necessary for doing business

Financial

- Verify financial information provided

- Obtain bank accounts and statements

- Examination of accounts and underlying performance of business

- Details of any property owned by the business, including mortgages

Commercial

- The market that the business operates within and its market share

- Customers: list of major customers. Is the business dependant on just a few customers? Can you talk to some customers?

- Suppliers: list of major suppliers. Is the business dependant on a few suppliers?

- Competitors and the unique advantage that this business may have.

- Assumptions that lie behind the business plan

- Insurances held

- Guarantees and terms & conditions of sale that the business gives

Human Resources

- Management background check

- Key personnel staying / losing

- Pension commitments

IT / Systems

- Hardware and important software used within the business

- State of the systems, are they up-to-date, using appropriate technology

- Compatibility to any existing systems if merging businesses

For Investors, where possible always use professional legal and accounting firms who will have a VERY detailed question check list for carrying out due-diligence. For smaller or even start-up businesses it may be that a simple management check and time taken to understand the market and the advantages of the business is enough. That is for you to decide, but you must make sure you do all necessary to verify people and facts.

Both Investors and Business Owners should be aware that due-diligence takes time and can be detrimental for the business when the owner is distracted from normal operating duties by needing to find all the due-diligence documentation required and in answering the questions raised, but it is an essential part of selling or getting investment.

I talk to a lot of owners of businesses each year who are putting all their time, energy and money into growing their business and have no plans to use any of that hard fought cash to pay into a pension.

I talk to a lot of owners of businesses each year who are putting all their time, energy and money into growing their business and have no plans to use any of that hard fought cash to pay into a pension.

You don’t know when you might bump into or be talking to a useful contact, business partner or even potential Investor. This first conversation is your best chance to impress and could determine whether you get a second more detailed conversation or meeting.

You don’t know when you might bump into or be talking to a useful contact, business partner or even potential Investor. This first conversation is your best chance to impress and could determine whether you get a second more detailed conversation or meeting. 1. Work on your brand and image.

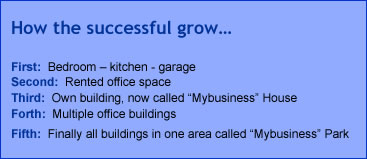

1. Work on your brand and image. Being investment ready is key to getting funding. Yet when talking to entrepreneurs they often have not taken the time to think it through.

Being investment ready is key to getting funding. Yet when talking to entrepreneurs they often have not taken the time to think it through. Many of the people that I’ve talked to recently are individuals, they have a need for funding to start-up or to get greater growth, so they are talking to me about finding investment.

Many of the people that I’ve talked to recently are individuals, they have a need for funding to start-up or to get greater growth, so they are talking to me about finding investment. Whether you’re writing a business plan, or simply want to make sure that your business has customers, you are going to need a sales plan and a marketing plan.

Whether you’re writing a business plan, or simply want to make sure that your business has customers, you are going to need a sales plan and a marketing plan. In a previous work life, I used to give presentations on technology and as a way of lightening the tone of what could be a heavy session, I showed a cartoon. The caption read “In a moment of inspiration Dave the repairman connected the air-conditioner to the Internet”.

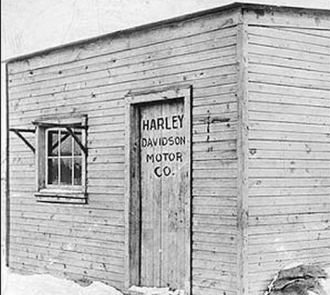

In a previous work life, I used to give presentations on technology and as a way of lightening the tone of what could be a heavy session, I showed a cartoon. The caption read “In a moment of inspiration Dave the repairman connected the air-conditioner to the Internet”. I’m always saying that ideas are 10 a penny, it’s getting off your backside and doing it (and doing it well) that counts.

I’m always saying that ideas are 10 a penny, it’s getting off your backside and doing it (and doing it well) that counts.